A tiny intro

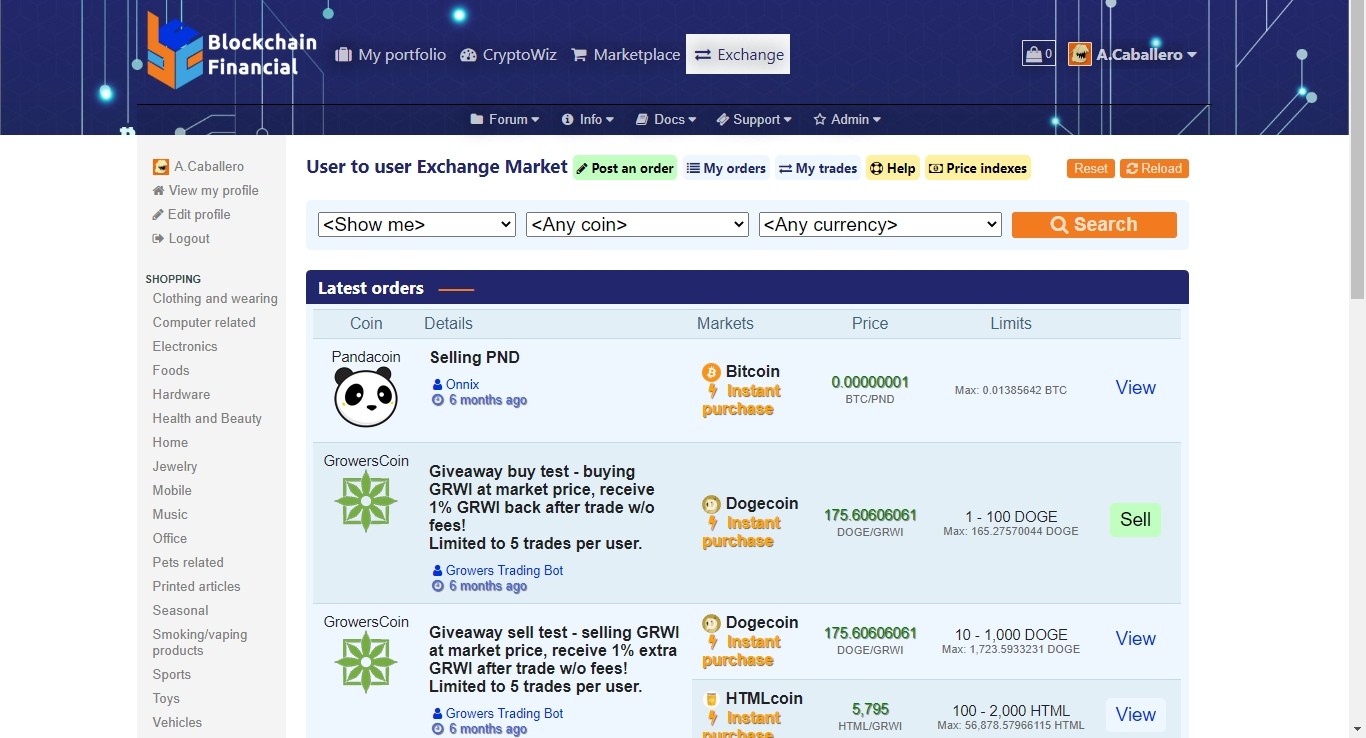

The online trading business has heavy competition, but most online exchanges assume everyone has some knowledge or they have huge amounts of money to risk.

People who has a few coins worth a handful of dollars that don't know anything about trading and might get a piece of their stack being cut by transaction fees is left unchecked.

If you're one of them, we welcome you. And if you're a pro, you're included.

One of the key features of our exchange is the ability to place orders on multiple markets at once.

How orders are managed everywhere else

On the average exchange, you need to split your stack and post trading orders on multiple markets.

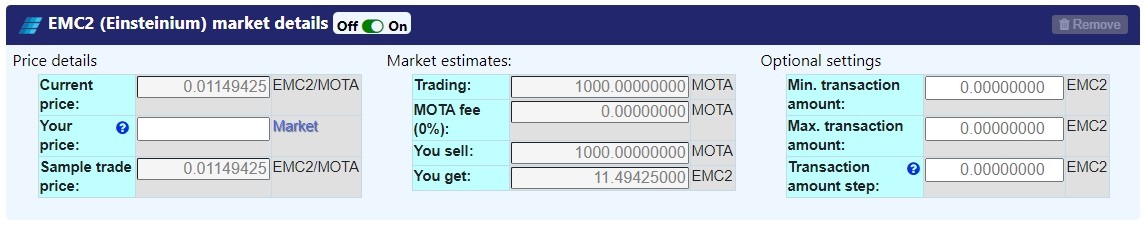

Let's say that you have 1000 MOTA and want to diversify by buying EMC2 and PND without caring on how much you get from each one.

On a normal exchange, you'll have to decide how much of those MOTA you'll post on the EMC2 market and post the rest on the PND market.

That, supposing there are MOTA/EMC2 and MOTA/PND markets, but most of the time you'll have to first convert your MOTA to BTC, LTC or other major market.

Pros:

- You have tight control on how much you're trading.

Cons:

- You might have to convert your coins to major markets to submit the trades.

- You will have to monitor the markets in order to get the best price, either manually or using a trading bot (like GrowBot).

- If one of the markets slide, you'll have to cancel orders and repost trades on the other market.

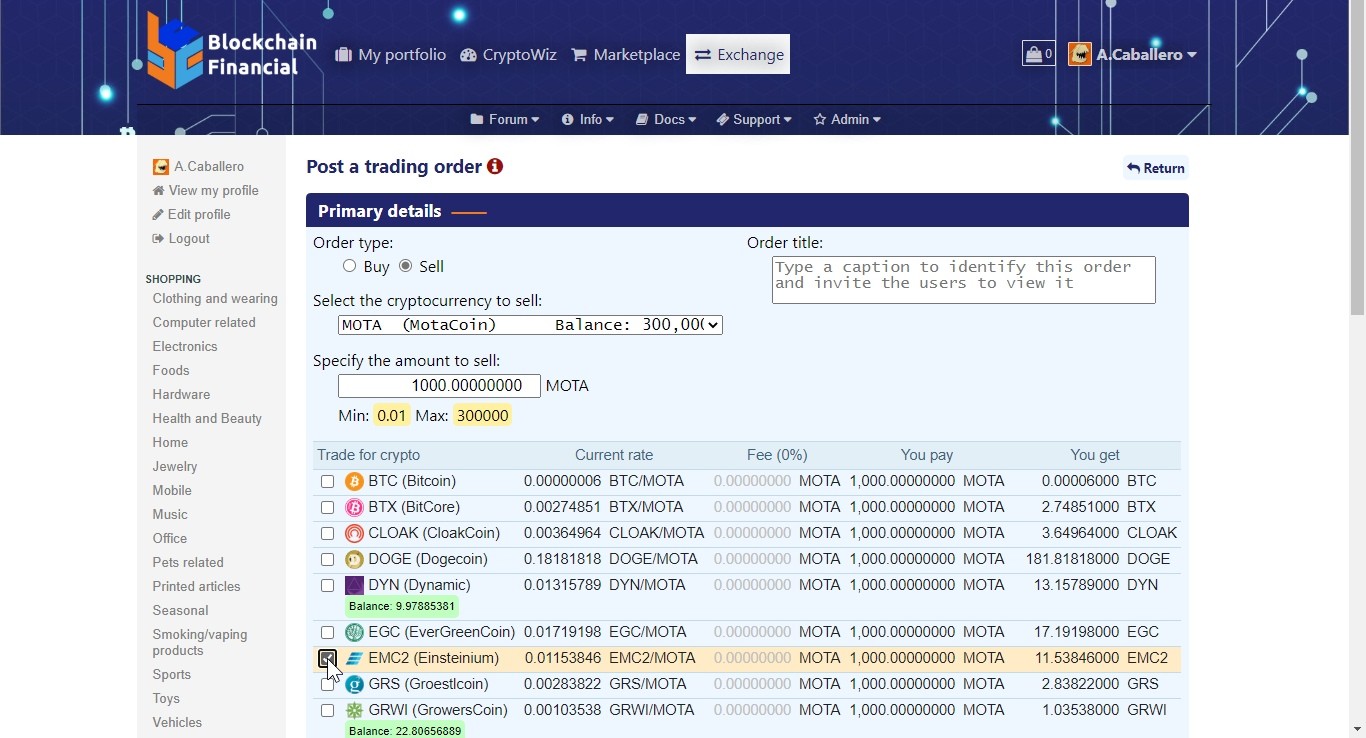

Single coin orders on Blockchain Financial

On Blockchain Financial, our trading engine is a bit different: every order you post can be set to multiple markets.

If you want to buy or sell a coin for another coin, you just pick the options and set the order settings:

1. Select the coin to give, specify the amount and pick the coin you want to get in return.

2. Tune the options and submit the order.

Pros:

- You have tight control on how much you're trading.

- You don't need to convert your coins to some major market beforehand.

Cons:

- We found none. If you found one, please tell us!

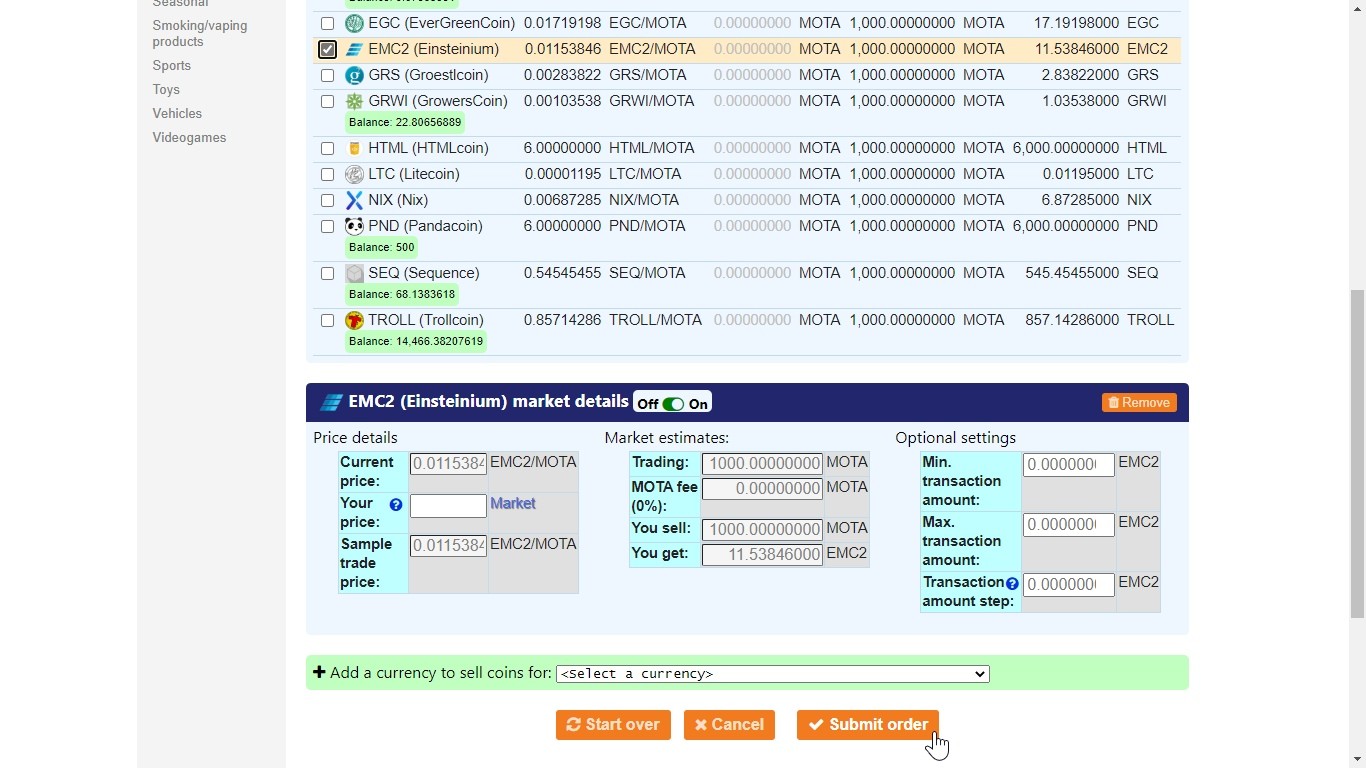

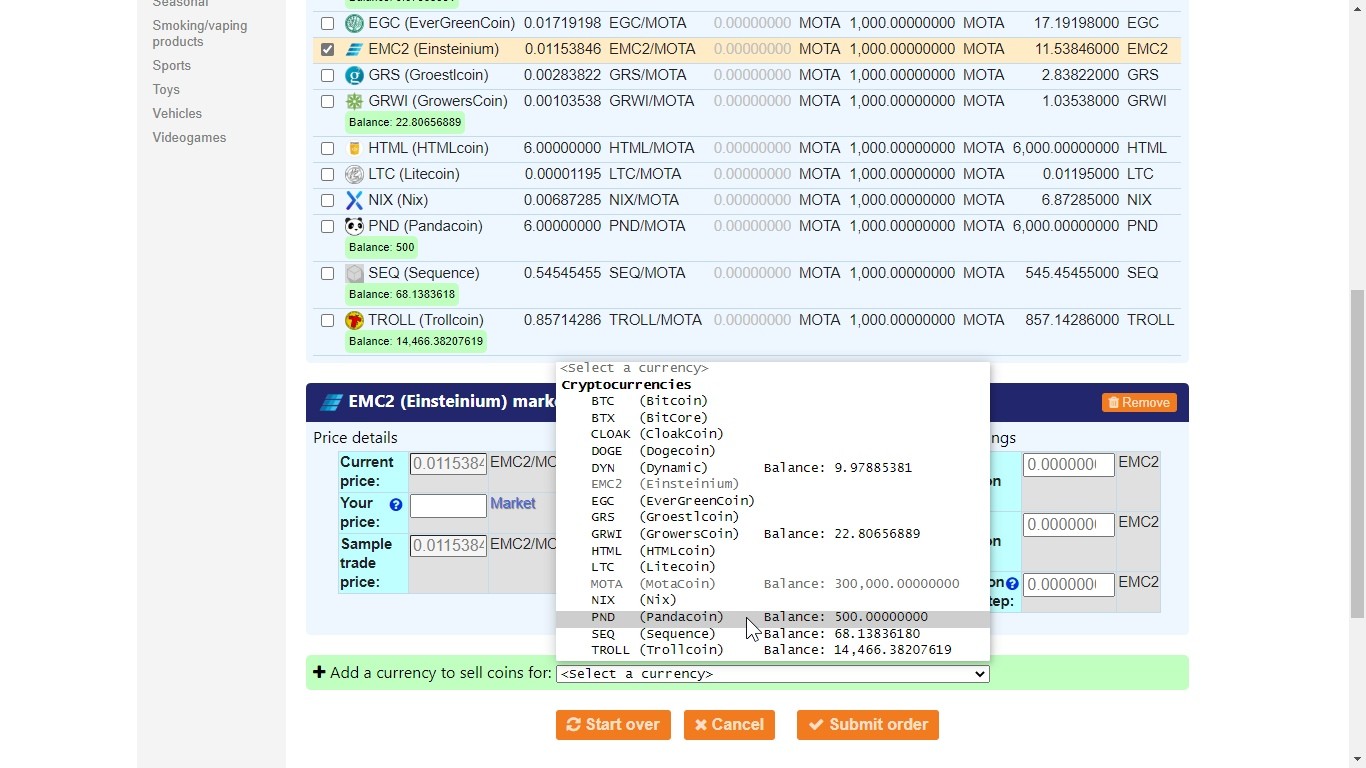

Multimarket orders

On Blockchain Financial, you don't need to split your stack in order to get more than one coin in exchange. Following the example above:

You have 1 BTC and want to diversify by buying DOGE and LTC without caring on how much you get from each one.

You just need to post an order where you specify the BTC you want to trade out, and simply add DOGE and LTC to it...

Just check the boxes from the coins table or add it from the list at the bottom...

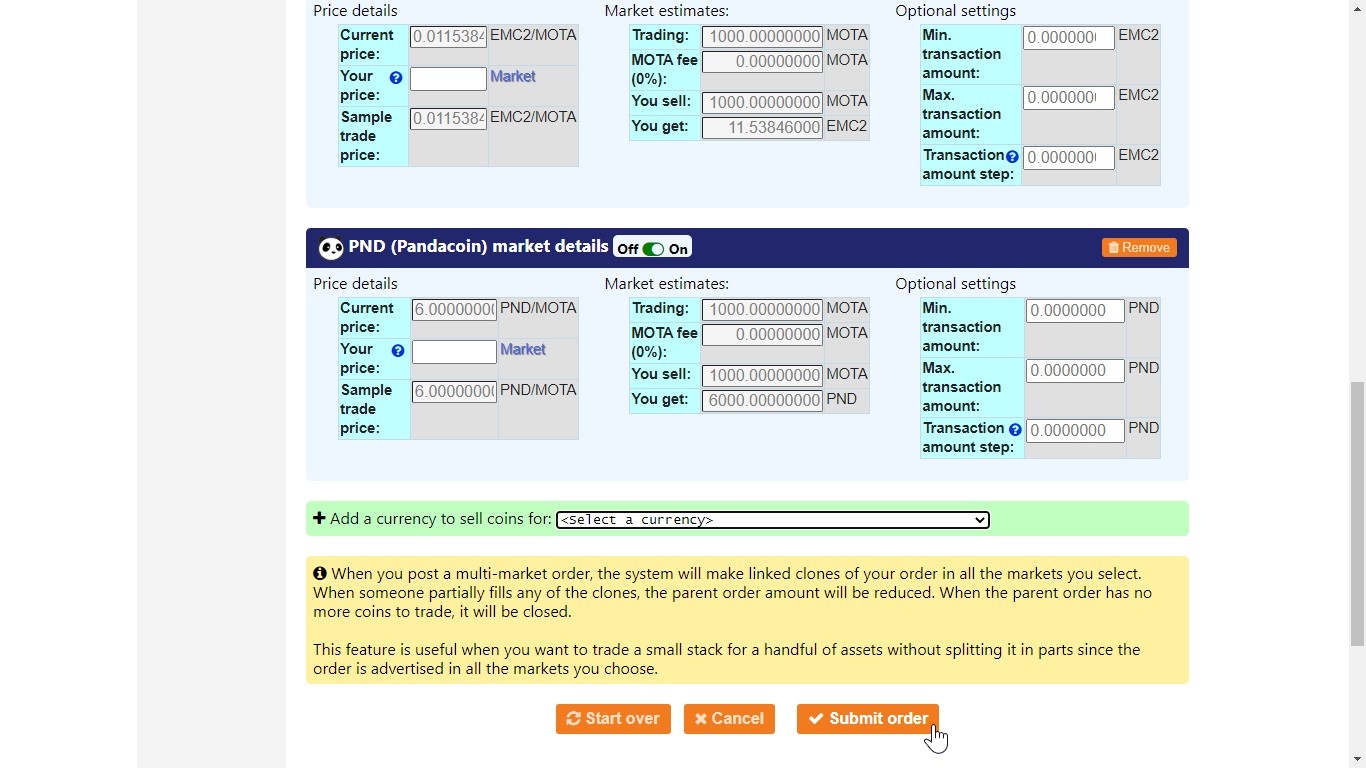

Tune in and submit the order.

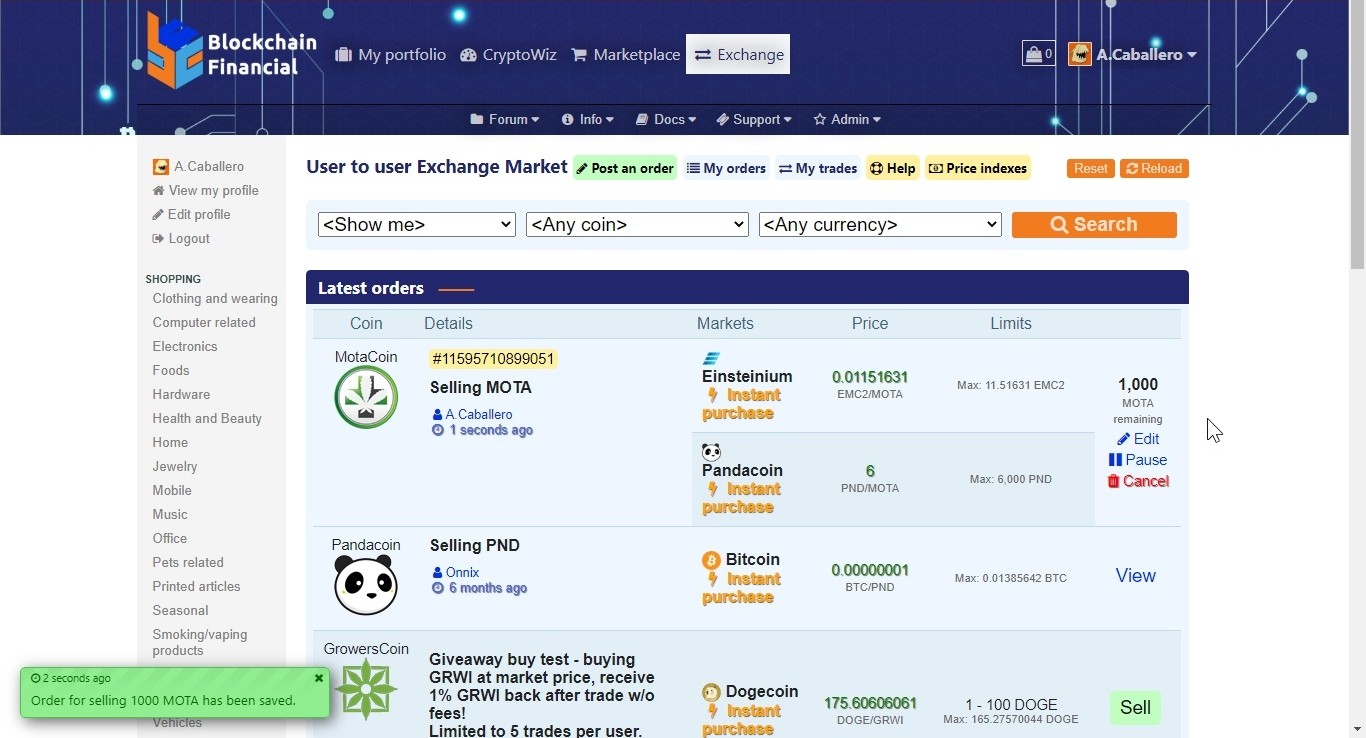

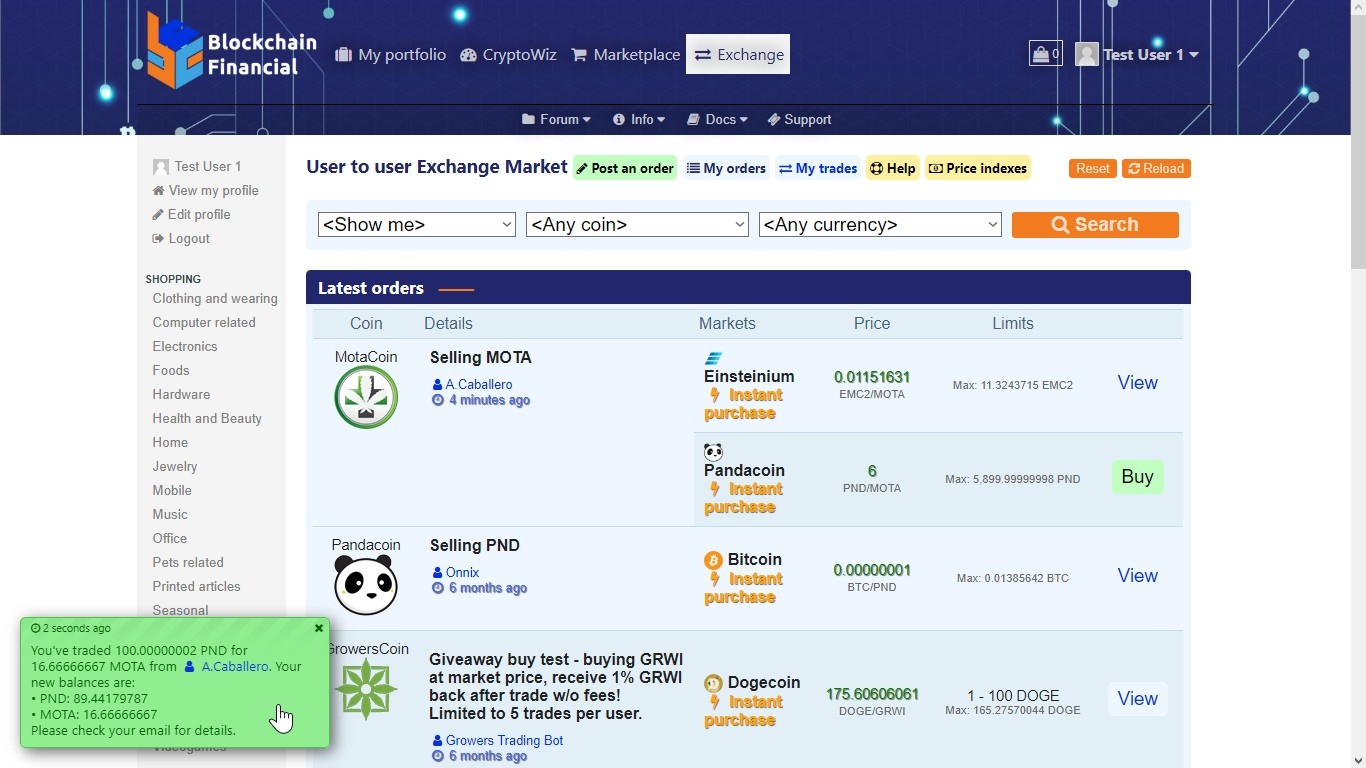

Once you submit the order, it will look like this on the listings:

You'll see it like this:

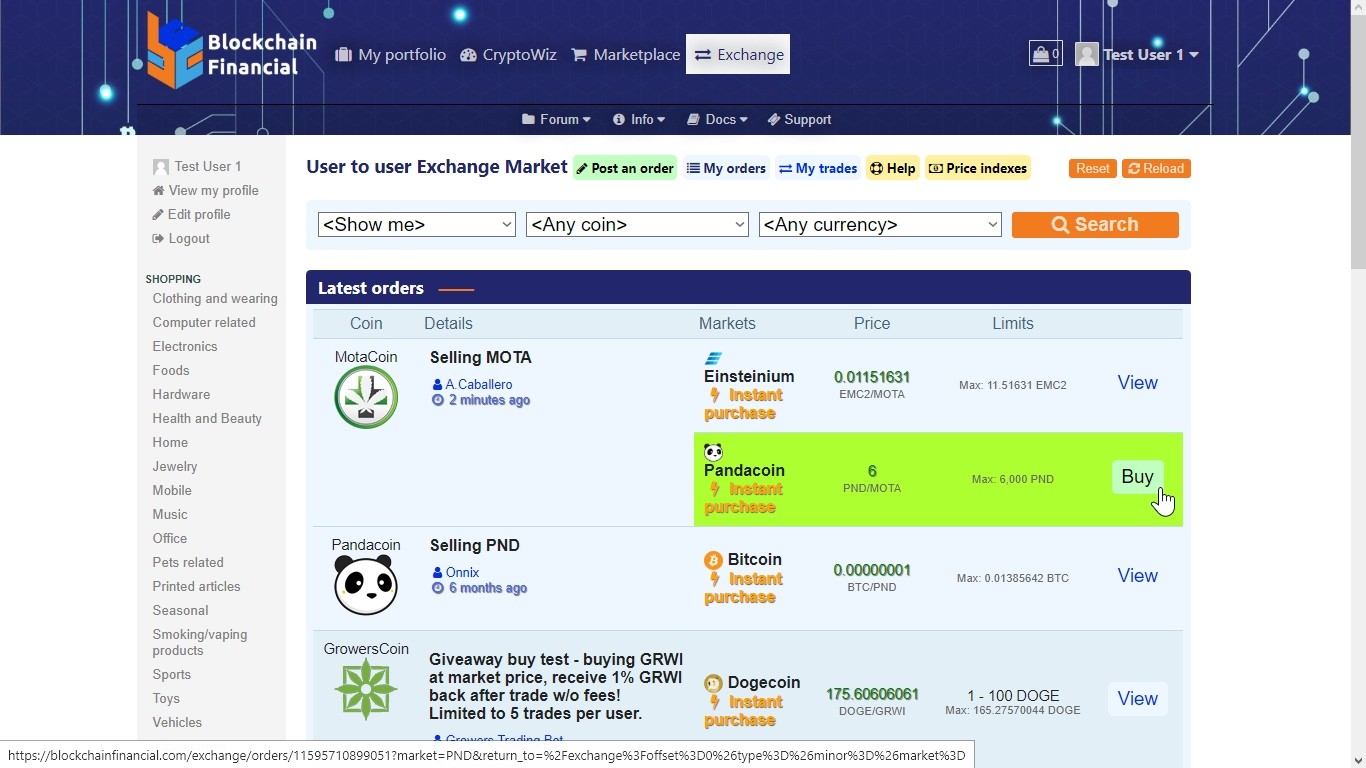

Other users will see it like this:

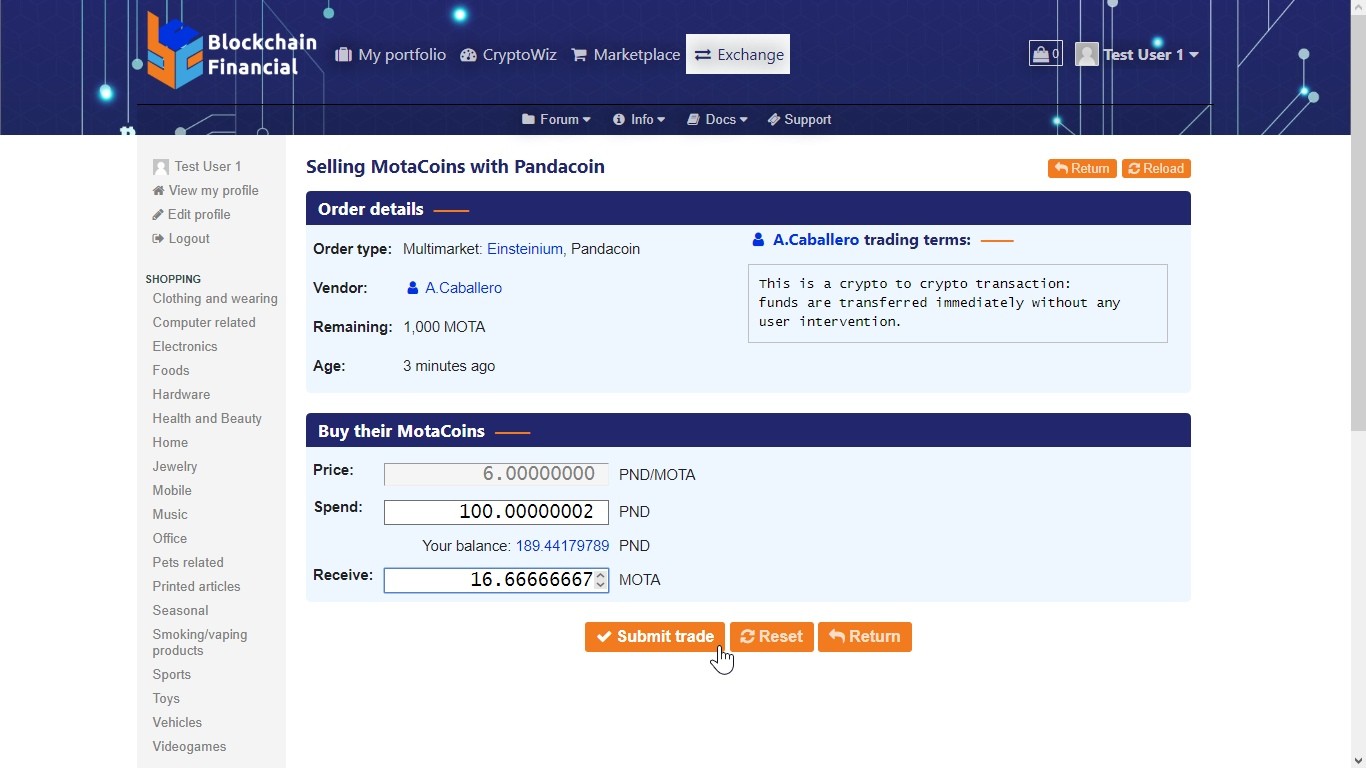

If someone takes the order to get some of your coins:

In this example, a partial fill takes place:

After submitting the trade, the taker is notified:

The transaction is deducted from the order, leaving the rest of the coins for anyone else to get them using one or other coins:

If you want to set limits to your order, you can set transaction limits on each market:

Pros:

- You don't need to split the stack you're trading.

- You don't need to trade them on major markets beforehand.

- You can set transaction limits.

- You can get the best deals without having to stop and remake orders.

- You can add and disable markets anytime.

Cons:

- Really? Are there any cons?

If you want to automate trading...

Our exchange has an API. If you use a trading app or online service like GrowBot, you can define an API keypair to allow remote management on your behalf.

Do you know you can set a label to Blockchain Financial?

Blockchain Financial has a system that lets users stick labels to other users

as an alternative way to show their appreciation or discontent for

the contents of their posts or their attitude when commenting.

Blockchain Financial has a system that lets users stick labels to other users

as an alternative way to show their appreciation or discontent for

the contents of their posts or their attitude when commenting.

Do you want to be part of the elite? Become a valuable contributor!

CoinMarketCap

CoinMarketCap CoinPaprika

CoinPaprika

Click here to register now!