Not so long ago, major cryptocurrencies on exchanges all over the world followed Bitcoin prices: when BTC/USD went up, most cryptos on BTC markets went up. That's how we saw assets like Dogecoin and Litecoin, even Ethereum, goin up or down at Satoshi level.

We noticed a change in that behavior. Now most major cryptos have been switching their core value to USD, and most traders stick to USD markets instead of BTC markets. That's something we can't ignore and we need to take measures now.

The Satoshi factor

Since the conception of our exchange, we've been giving unlisted and sub-satoshi assets a minimum value of 1 Satoshi. HTMLcoin, for instance, is currently sub-satoshi on other exchanges, and all HRC20 tokens here aren't listed anywhere else, thus, their fallback price has been 1 sat, and from there, we process all conversions against the other assets in our catalog. At some excerpt, Pandacoin have been subsat for a while, rosing the Satoshi line several times and bouncing back to subsat levels.

Some time ago we had a discussion with the HTML and PND guys and discussed about changing the algo so our so called "Satoshi factor" was rechecked, and we ended up leaving it as it was for the time being, but as we mentioned above, the whole crypto market is changing.

Our price indexes algo

As we explain in our price indexes page, we download listings against BTC markets from CoinGecko every few minutes. Then we convert rates to all fiat currencies and all crypto assets to build market price listings.

In a recent change, we added local trade rates in preparation for listing our exchange in places like CoinGecko and CoinMarketCap.

We had a long chat with an experienced trader and got the next recommendations:

- Local trades might not reflect local markets and stick to downloaded rates so we don't have a feedback loop in the long term.

- All downloaded rates should be calculated against the USD and then cross-converted.

- No more 1 Satoshi fallback. If an asset price goes below 1 sat then BTC market becomes unavailable for that asset unless a specific rate is set (no more market/dynamic rates for these assets).

- All assets that aren't listed anywhere would end up needing a specific rate to be set (no more market/dynamic rates here).

Regarding the first topic: we showed our algo update and our measures to prevent that feedback loop, but with the input provided by this great guy, we noticed that it didn't matter: the feedback was going to hit anyway.

Regarding the removal of the "Satoshi factor", we had to dig deeper.

The changes ahead

During the next days, we'll take a deeper look at the issue at hand and implement the solution once tests are successful.

So you should expect news soon, within the first week of November.

An extra step

We already mentioned before that the SVM token is oversold on our exchange. Everyone wants to dump it and there are no buyers.

On top of that, there are people posting sell orders without thinking on a good price for them. They just want a quick cash no matter how much it is. And that is hurting them and hurting the token.

We can't control market prices, and uneducated traders aren't careful enough to understand the damage they inflict on themselves and the token.

A limit was set

We enforced a limit in the SVM market: there is a sell/buy orders ratio of 3:1. This means there can't be more than three times the sell orders than the buy orders against SVM.

And this affects both sides of the order... selling SVM for HTML is the same as buying HTML with SVM.

Still with that limit, people that posted SVM orders after our last purge weeks ago still have their orders open in the exchange, without anyone taking them.

And they aren't giving other people chance to try to sell their tokens.

A new limit will be set

We'll enforce order expiration on flooded markets like SVM. If an order hasn't been filled partially in seven days, it will be taken down.

Please stay tuned

We urge all our users to stay tuned and follow up our announcements. We want everyone to get good results by using our services, and that's what drives us to improve our code.

Follow us on Telegram, Facebook, Twitter or Linkedin, and don't ignore important announcements like this one.

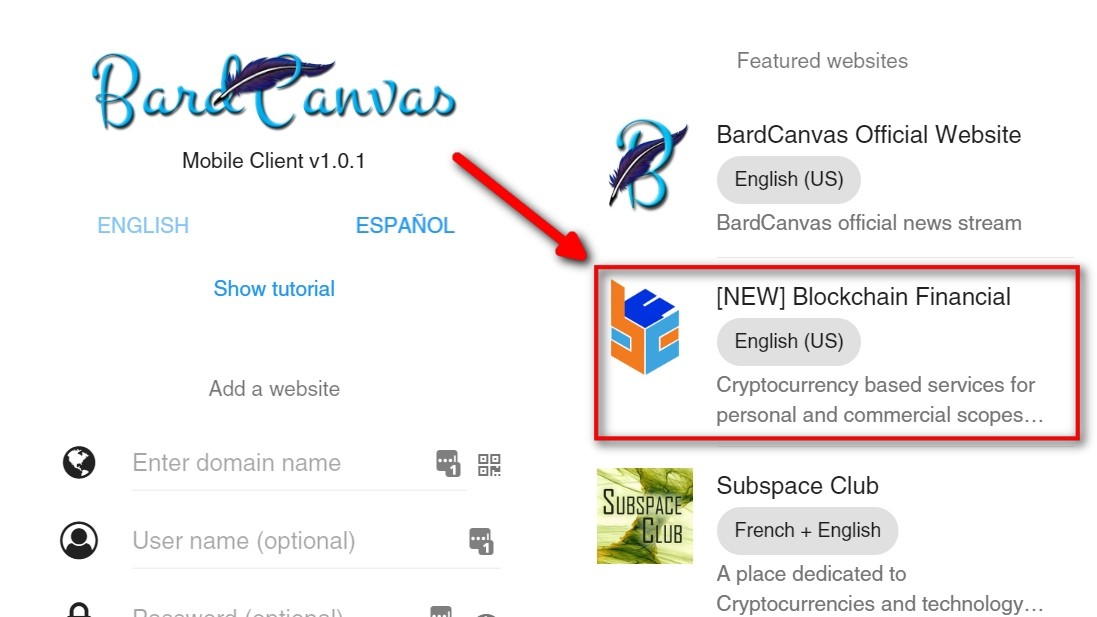

Blockchain Financial has the next label sticked since 18 hours ago:

A great contributor:

A user that stands out for doing the right thing in the website. Cheers to you!

A great contributor:

A user that stands out for doing the right thing in the website. Cheers to you!

Sticked by

lii 18 hours ago

• Source: Coins info

• Reason: N/A

CoinMarketCap

CoinMarketCap CoinPaprika

CoinPaprika

Understand